Centralised clearance procedure – Standard customs declaration

On this page you can read about how to use centralised clearance and submit a standard customs declaration to Swedish Customs.

Those who have authorisation for centralised clearance in Sweden send their customs declarations to Swedish Customs (Supervising Customs Office, SCO) for goods entering another Member State (Presentation Customs Office, PCO). A declarant with an authorisation for centralised clearance can also use a customs representative for their contacts and communication with Swedish Customs. In this case, the customs representative acts on behalf of the declarant as a direct customs representative. In the case of indirect representation, it is the customs representative who must have the authorisation for centralised clearance.

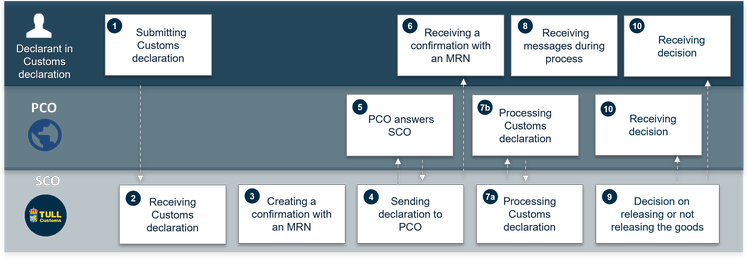

The picture below shows how it works when you use centralised clearance and submit a standard customs declaration to Swedish Customs. Under the image, you can read descriptions of what happens in each step.

In this description, it is stated that Swedish Customs will communicate with the declarant, regardless of whether the communication takes place directly with the declarant or via their representative.

A description of each role can be found here: Terms and responsibilities in the new import procedure (in Swedish)

Click on the image to enlarge.

Procedure description

1. Creating a standard customs declaration

When using an authorisation for centralised customs clearance for goods from countries outside of the EU you should always lodge a customs declaration to Swedish Customs (SCO). The goods will then enter the EU in another Member State (PCO).

The declarant in the customs declaration creates a standard customs declaration and submits it digitally to Swedish Customs. The customs declaration will then contain a Local Reference Number (LRN).

2. Receiving the standard customs declarations

Swedish Customs receives the standard customs declaration and verifies that the information is correctly entered.

- In the event of errors, the customs declaration will be stopped. A message will be sent to inform the declarant in the customs declaration that the customs declaration cannot be processed.

- If the information is correct, a message will be sent to the declarant in the customs declaration to inform the declarant in the customs declaration that the declaration has been received.

In the next step, the system will cross-check the information against TARIC and applicable authorisations.

- If any of these entries are incorrect, for example, if a commodity code that does not exist in Tulltaxan (TARIC) is used, a message will be sent in the customs declaration to inform the declarant in the customs declaration of the errors (received with errors). The declarant in the customs declaration will be given an opportunity to amend the errors and re-submit the customs declaration.

3. Creating a file

A file will now be created with Swedish Customs.

4. Submit the declaration to the PCO

The information in the customs declaration will be sent to the PCO, which will also verify the information.

5. The PCO responds to the SCO

Once the PCO has verified the information in the declaration, they will send a response to the SCO.

6. Approved with an MRN

If no errors are found in the above checks at the SCO and PCO, an MRN is assigned to the customs declaration. The declarant in the customs declaration will be informed that the check was successful. The MRN will be included in this message. The status Lodged and Approved will also be included in this message.

If the customs declaration is submitted in advance, the customs declaration is linked to the standard customs declaration procedure in this step.

7. Processing the standard customs declaration

a. The SCO

Swedish Customs (SCO) will now verify that the information in the customs declaration is correct and can form the basis of a decision in the matter. They will then forward the information in the declaration to the PCO.

b. The PCO

The PCO receives the information in the customs declaration, determines if the goods can be released, and informs the SCO.

8. Receiving messages while the case is processed

The declarant in the customs declaration will receive any digital messages sent by Swedish Customs to request supporting documents and inform that an examination of the goods will be conducted.

Supporting documents should be submitted via Swedish Customs’ online service Uppladdning av handling (uploading documents). A link to this online service is included in the message; however, your company needs access to the online services.

Once any necessary checks have concluded, the declarant in the customs declaration will be notified of the outcome of the checks.

9. Decision to release or not release the goods

Swedish Customs (SCO) decides in consultation with the PCO whether the goods can be released or not.

- If the goods may be released, Swedish Customs will determine the amount of customs duty. A decision to release the goods will be sent to the declarant in the customs declaration and the PCO. The PCO will determine any national taxes or fees, as well as VAT.

- If Swedish Customs (SCO) is considering not releasing the goods, the declarant in the customs declaration will be notified. The declarant is given 30 days to lodge an appeal or opinion. If the declarant does not lodge an appeal that affects Swedish Customs’ position, a decision not to release the goods will be made, and the declarant in the customs declaration and the PCO will be notified.

10. Receiving the decision

The declarant in the customs declaration and the PCO receives the decision to release the goods.

Last updated: