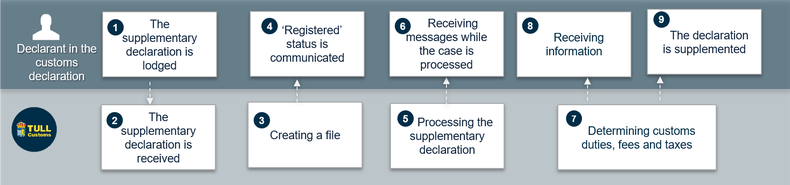

Procedure for supplementary declarations

If you have previously submitted a simplified declaration or entry in the declarants´s records, it should be followed by a supplementary declaration.

If a simplified declaration has been submitted to Swedish Customs or if a customs declaration has been lodged via entry in the declarant's records, a supplementary declaration must be submitted within 10 days of release. This is the process for lodging a supplementary declaration under the new import procedure.

The image below describes how to lodge a supplementary declaration. Under the image, you can read descriptions of what happens in each step.

Zoom image

Zoom imageClick on the image to enlarge

Roles

The declarant is the person who lodges a customs declaration in their own name or the person in whose name such a declaration is lodged.

There may be a declarant both in a customs declaration and in a presentation notification. To distinguish between these roles, the following designations are used:

- Declarant in the customs declaration

- Declarant in the presentation notification

This procedure only refers to the declarant in the customs declaration.