Procedure for customs declarations for low-value consignments

A customs declaration should always be submitted to Swedish Customs when goods are imported from countries outside the EU. For some low-value consignments you can submit a customs declaration for consignments of negligible value.

A customs declaration for consignments of negligible value can be used in the following cases:

- Gifts with a value that does not exceed €45;

- Consignments with a value that does not exceed €150;

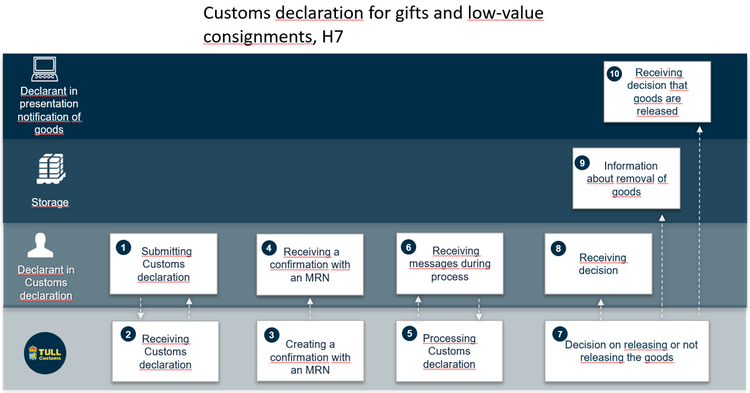

The image below describes how to submit a customs declaration for consignments of negligible value; Under the image, you can read descriptions of what happens in each step.

Zoom image

Zoom imageClick on the image to enlarge.

1. Creating a customs declaration

A customs declaration should always be submitted to Swedish Customs when goods are imported from countries outside the EU. The declarant indicated in the customs declaration draws the customs declaration and submits it digitally to Swedish Customs. The customs declaration will then contain a Local Reference Number (LRN).

A declarant may also hire an agent, who will handle their communications with Swedish Customs. The agent acts on behalf of the declarant.

2. Receiving the customs declaration

Swedish Customs receives the standard customs declaration and verifies that the information is correctly entered.

- In the event of errors, the customs declaration will be stopped. A message will be sent to inform the declarant that the customs declaration cannot be processed.

- If the information is correct, a message will be sent to the declarant in the customs declaration to inform the declarant that the declaration has been received.

In the next step, the system verifies the information.

- If any if these entries are incorrect, for example, the value exceeds the requested duty relief, a message will be sent in the customs declaration to inform the declarant of the errors (received with errors). The declarant will be given an opportunity to amend the errors and re-submit the customs declaration.

3. Creating a file

Swedish Customs (Master Reference Number) generates a file and assigns an Master Reference Number (MRN).

4. Approved with an MRN number

If the check is successful, an MRN number will be assigned to the customs declaration. The declarant will be informed that the check was successful. The MRN number will be included in this message. The status Lodged and Approved will also be included in this message.

5. Handling the customs declaration

Swedish Customs will now verify that the information in the customs declaration is correct and can form the basis of a decision in the matter.

At this point, the declarant in the customs declaration may be required to substantiate the information provided. Supporting documents can be uploaded and submitted in Swedish Customs’ online services. If an examination of the goods is required, the declarant will be notified.

6. Receiving messages while the case is processed

The declarant will receive any digital messages sent by Swedish Customs to request supporting documents and inform that an examination of the goods will be conducted.

Supporting documents should be submitted via Swedish Customs’ online service Uppladdning av handling (uploading documents). A link to this online service is included in the message; however, your company needs access to the online services.

Once any necessary examinations have concluded, the declarant will be notified of the outcome of the examination.

7. Decision to release or not release the goods

Swedish Customs will verify the correctness of the information in the customs declaration and decide whether or not the goods may be released.

- If the goods may be released, Swedish Customs will determine the amount of VAT and other fees. The declarant will be notified of the decision.

- If Swedish Customs is considering not releasing the goods, the declarant will be notified. The declarant is given 30 days to lodge an appeal or opinion. If the declarant does not lodge an appeal that affects Swedish Customs’ position, a decision not to release the goods will be made, and the declarant will be notified.

8. Receiving the decision

The declarant indicated in the customs declaration receives the decision to release the goods, or the decision not to release the goods.

9. Permission to remove the goods from the warehouse

If the goods are released, the storage owner will receive a removal notification. This information can be accessed from Swedish Customs’ online services.

10. Notification of release of goods

This only occurs in cases presentation notification and the customs declaration are submitted by separate parties. If the goods are released, the declarant from the presentation notification will also be notified.